This is default featured slide 1 title

Go to Blogger edit html and find these sentences.Now replace these sentences with your own descriptions.

This is default featured slide 2 title

Go to Blogger edit html and find these sentences.Now replace these sentences with your own descriptions.

This is default featured slide 3 title

Go to Blogger edit html and find these sentences.Now replace these sentences with your own descriptions.

This is default featured slide 4 title

Go to Blogger edit html and find these sentences.Now replace these sentences with your own descriptions.

This is default featured slide 5 title

Go to Blogger edit html and find these sentences.Now replace these sentences with your own descriptions.

Showing posts with label Central Government Employee News. Show all posts

Showing posts with label Central Government Employee News. Show all posts

Thursday, March 27, 2014

Dearness Allowance to Central Government employees - Revised Rates effective from 1.1.2014 Finance Ministry Issued Orders

No.1/1/2014-F-II

(B)

Government

of India

Ministry

of Finance

Department

of Expenditure

North Block, New Delhi

Dated: 27th March. 2014

OFFICE MEMORANDUM

Subject: Payment of

Dearness Allowance to Central Government employees - Revised Rates effective

from 1.1.2014.

The undersigned is

directed to refer to this Ministry’s Office Memorandum No.I-8/2013-E-II (B)

dated 25th September, 2013 on the subject mentioned above and to say that the

President is pleased to decide that the Dearness Allowance payable to Central

Government employees shall be enhanced from the existing rate of 90% to 100%

with effect from January, 2014.

2. The provisions

contained in paras 3, 4 and 5 of this Ministry’s O.M. No.1(3)/2008-E-11(B)

dated 29th August, 2008 shall continue to be applicable while regulating

Dearness Allowance under these orders.

3. The additional

installment of Dearness Allowance payable under these orders shall be paid in

cash to all Central Government employees.

4. The payment of arrears

of Dearness Allowance shall not he made before the date of disbursement of

salary of March. 2014.

5. These orders shall also

apply to the civilian employees paid from the Defence Services Estimates and

the expenditure will be chargeable to the relevant head of the Defence Services

Estimates. In regard to Armed Forces personnel and Railway employees, separate

orders will he issued by the Ministry of Defence and Ministry of Railways,

respectively.

6. In so far as the

employees working in the Indian Audit and Accounts Department are concerned,

these orders are issued with the concurrence of the Comptroller and Auditor

General of India.

sd/-

(A.Bhattacharya)

Under Secretary to the

Government of India

View Official Order: Click Here

Wednesday, March 12, 2014

Declaration of Holiday on 14th April, 2014 – Birthday of Dr.B.R. Ambedkar

F. No.12/4/2014-JCA-2

Government of India

Ministry of Personnel, Public

Grievances & Pensions

(Department of Personnel &

Training)

North Block, New Delhi

Dated the 12th March, 2014.

OFFICE MEMORANDUM

Subject: Declaration of Holiday on 14th

April, 2014 – Birthday of Dr.B.R. Ambedkar.

It has been decided to declare Monday, the

14th April 2014, as a Closed Holiday on account of the birthday of Dr. B.R.

Ambedkar, for all Central Government Offices including Industrial

Establishments throughout India.

2. The above holiday is also being notified

in exercise of the powers conferred by Section 25 of the Negotiable Instruments

Act, 1881 (26 of

1881).

3. All Ministries/Departments of Government

of India may bring the above decision to the notice of all concerned.

sd/-

(Ashok Kumar)

Deputy Secretary to the Government of

India

Friday, February 28, 2014

Dearness Allowance for Central Government Employees at 100% after 10% hike approved by Govt

>> The Union Cabinet today(28 Feb

2014) approved the proposal to release an additional installment of Dearness

Allowance (DA) to Central Government employees and Dearness Relief (DR) to

pensioners with effect from 01.01.2014, in cash, but not before the

disbursement of the salary for the month of March 2014 at the rate of 10

percent increase over the existing rate of 90 percent.

>> Hence, Central Government

employees as well as pensioners are entitled for DA/DR at the rate of 100

percent of the basic with effect from 01.01.2014. The increase is in accordance

with the accepted formula based on the recommendations of the 6th Central Pay

Commission.

>> The combined impact on the

exchequer on account of both dearness allowance and dearness relief would be

Rs. 11074.80 crore per annum and Rs. 12920.60 crore in the financial year

2014-15 ( i.e. for a period of 14 months from January 2014 to February 2015).

Official order will be published in this

blog on release of the same by Finance Ministry.

Tuesday, February 4, 2014

Justice Ashok Kumar Mathur appointed to head 7th Central Pay Commission

4.2.14

7th Central Pay commission, Central Government Employee News, Current Affairs, Govt. Orders

No comments

Prime Minister Approved Composition of 7th

Central Pay Commission Under the Chairmanship of Justice Ashok Kumar Mathur,

Retired Judge of the Supreme Court and Retired Chairman, Armed Forces Tribunal

The Finance Minister Shri P.

Chidambaram has issued the following statement:

“The Prime Minister has approved the composition of the 7th Central Pay

Commission as follows:

1. Shri Justice Ashok Kumar Mathur - Chairman

(Retired Judge of the Supreme Court and Retired

Chairman, Armed Forces Tribunal)

2.

Shri Vivek Rae - Member

(Full Time)

(Secretary, Petroleum & Natural Gas)

3. Dr.

Rathin Roy - Member

(Part Time)

(Director, NIPFP)

4.

Smt. Meena Agarwal - Secretary

(OSD, Department of Expenditure, Ministry of Finance)”

Source: PIB

Sunday, January 5, 2014

Central Government Employees Holiday Calendar 2014 PDF Download

Here is the Central Government

Employees Holiday Calendar 2014 including

Central Government Holidays/ Restricted Holidays. Here we have prepared

calendar in PDF Format of Delhi Region, Tamil Nadu Circle and Kerala Circle.

For other Regions/Circles a calendar including

only the compulsory holidays has been prepared. It has been prepared in such a

friendly manner that they can download and print the calendar and mark their

holidays. Hope this helps you all....

If you notice any mistakes please bring it

to our notice so that we can update it....

Delhi Region

Calendar

Download As PDF: Click Here

Tamil Nadu

Circle Calendar

Download As PDF: Click Here

Kerala Circle

Calendar

Download As PDF: Click Here

Calendar for other Circles/Region: Click Here

Saturday, December 21, 2013

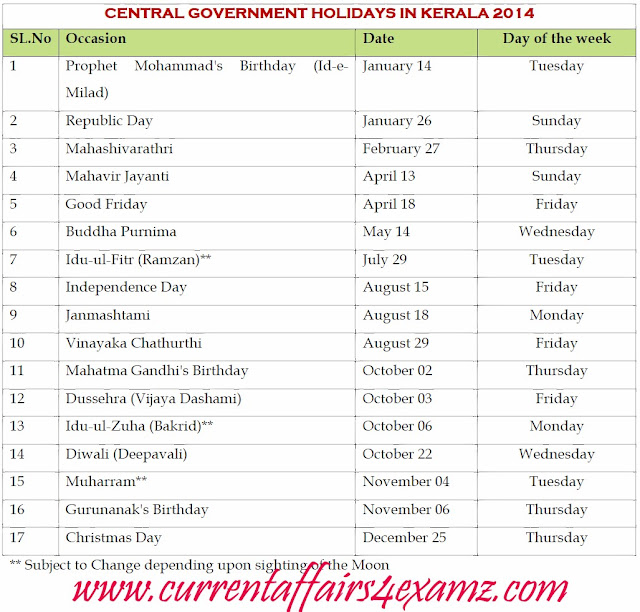

Central Government Holidays in Kerala 2014

Central Government Holidays in

Kerala 2014

Here

is the list of Central Government Holidays in Kerala for the Year 2014

CENTRAL

GOVERNMENT HOLIDAYS IN KERALA 2014

|

|||

SL.No

|

Occasion

|

Date

|

Day of the week

|

1

|

Prophet

Mohammad's Birthday (Id-e-Milad)

|

January 14

|

Tuesday

|

2

|

Republic

Day

|

January 26

|

Sunday

|

3

|

Mahashivarathri

|

February 27

|

Thursday

|

4

|

Mahavir

Jayanti

|

April 13

|

Sunday

|

5

|

Good

Friday

|

April 18

|

Friday

|

6

|

Buddha

Purnima

|

May 14

|

Wednesday

|

7

|

Idu-ul-Fitr

(Ramzan)**

|

July 29

|

Tuesday

|

8

|

Independence

Day

|

August 15

|

Friday

|

9

|

Janmashtami

|

August 18

|

Monday

|

10

|

Vinayaka

Chathurthi

|

August 29

|

Friday

|

11

|

Mahatma

Gandhi's Birthday

|

October 02

|

Thursday

|

12

|

Dussehra

(Vijaya Dashami)

|

October 03

|

Friday

|

13

|

Idu-ul-Zuha

(Bakrid)**

|

October 06

|

Monday

|

14

|

Diwali

(Deepavali)

|

October 22

|

Wednesday

|

15

|

Muharram**

|

November 04

|

Tuesday

|

16

|

Gurunanak's

Birthday

|

November 06

|

Thursday

|

17

|

Christmas

Day

|

December 25

|

Thursday

|

**

Subject to Change depending upon sighting of the Moon

Saturday, September 28, 2013

Grant of Non-Productivity Linked Bonus (ad-hoc bonus) to Central Government Employees for the year 2012-13.

Grant of Non-Productivity Linked Bonus (ad-hoc bonus) to Central

Government Employees for the year 2012-13.

No.7/24/2007/E

III (A)

Government

of India

Ministry

of Finance

Department

of Expenditure

E

III (A) Branch

New Delhi, the 27th September, 2013

OFFICE

MEMORANDUM

Subject : Grant of Non-Productivity Linked

Bonus (ad-hoc bonus) to Central Government Employees for the year 2012-13.

The undersigned is directed to convey the

sanction of the President to the grant of Non-Productivity Linked Bonus (Ad-hoc

Bonus) equivalent to 30 days emoluments for the accounting year 2012-13 to the

Central Government employees in Groups 'C’ and 'D’ and all non-gazetted

employees in Group 'B' who are not covered by any Productivity Linked Bonus

Scheme. The calculation ceiling for payment of ad-hoc Bonus under these orders

shall continue to be monthly emoluments of Rs. 3500/-, as hitherto. The payment

of ad-hoc Bonus under these orders will also be admissible to the eligible

employees of Central Para Military Forces and Armed Forces. The orders will be

deemed to be extended to the employees of Union Territory Administration which

follow the Central Government pattern of emoluments and are not covered by any

other bonus or ex-gratia scheme.

2. The benefit will be admissible subject

to the following terms and conditions:

(i) Only those employees who were in

service as on 31.3.2013 and have rendered at least six months of continuous

service during the year 2012-13 will be eligible for payment under these

orders. Pro-rata payment will be admissible to the eligible employees for

period of continuous service during the year from six months to a full year,

the eligibility period being taken in terms of number of months of service

(rounded off to the nearest number of months).

(ii) The quantum of Non-PLB (ad-hoc bonus)

will be worked out on the basis of average emoluments/calculation ceiling

whichever is lower. To calculate Non-PLB (Ad-hoc bonus) for one day, the

average emoluments in a year will be divided by 30.4 (average number of days in

a month). This will thereafter be multiplied by the number of days of bonus

granted. To illustrate, taking the calculation ceiling of monthly emoluments of

Rs, 3500 (where actual average emoluments exceed Rs. 3500), Non-PLB (Ad-hoc

Bonus) for thirty days would work out to Rs.3500x30/30.4 = Rs.3453.95 (rounded

offto Rs.3454/-).

(iii) The casual labour who have worked in

offices following a 6 days week for at least 240 days for each year for 3 years

or more(206 days in each year for 3 years or more in the case of offices

observIng 5 days week), will be eligible for this Non PLB (Ad-hoc Bonus)

Payment. The amount of Non-PLB (ad-hoc bonus) payable will be (Rs.1200x30/30.4

i.e.Rs.1184.21(rounded off to Rs,1184/-). In cases where the actual emoluments

fall below Rs.1200/- p.m., the amount will be calculated on actual monthly

emoluments.

(iv) All payments under these orders will

be rounded off to the nearest rupee.

(v) The clarificatory orders issued vide

this Ministry’s OM No.F.14(10)-E. Coord/88 dated 4.10.1988, as amended from

time to time, would hold good.

3. The expenditure on this account will be

debitable to the respective Heads to which the pay and allowances of these

employees are debited.

4. The expenditure incurred on account of

Non-PLB (Ad-hoc Bonus) is to be met from within the sanctioned budge provision

of concerned Ministries/Departments for the current year.

5. In so far as the persons serving in the

Indian Audit and Accounts Department are concerned, these orders are issued in

consultation with the Comptroller and Auditor General of India.

sd/-

(Amar Nath Singh)

Deputy Secretary to the Govt of India

Wednesday, September 25, 2013

Seventh Central Pay Commission approved by Prime Minister of India

Prime

Minister of India Approved Constitution of Seventh Central Pay Commission

Finance Minister P.Chidambaram announced on

25 September 2013 that the Prime Minister of India Manmohan Singh approved the

constitution of the Seventh Central Pay Commission. Pay Commission, which will

go into the salaries, allowances and pensions of about 80 lakh of its employees

and pensioners. The average time taken by a Pay Commission to submit its

recommendations is around 2 years. In context with this, it is expected that

the recommendations of 7th CPC will be implemented with effect from 1 January

2016.

The setting up of the Commission, whose

recommendations will benefit about 50 lakh central government employees,

including those in defence and railways, and about 30 lakh pensioners, comes

ahead of the Assembly elections in 5 states in November and the general

elections next year.

Since the year 1947, six pay commissions

have been set up from time to time in order to review as well as make

recooemndations on the work and pay structure of civil and military divisions

of the Government of India. Government constitutes Pay Commission almost every

ten years to revise the pay scales of its employees and often these are adopted

by states after some modification.

The sixth Pay Commission was implemented

from January 1, 2006, fifth from January 1, 1996 and fourth from January 1,

1986.

The names of the chairperson and members of

the 7th Pay Commission and its terms of reference will be finalised shortly

after consultation with major stakeholders, Chidambaram said.

About the Central Pay

Commission

• The first Central Pay Commission was

constituted in May 1946 and its report was submitted by 1947 under the

Chairmanship of Srinivasa Varadachariar. The first Central Pay Commission was

based on the basic idea of living wages to employees.

• The approval of last or the sixth Central

Pay Commission was given in July 2006. The commission was established under the

Chairmanship of B.N.Srikrishna with the time duration of 18 months.

• The constitution of the Seventh Pay

Commission will include salaries, allowances and pensions of around 80 lakh

employees as well as pensioners.

• Recommendations of the Commission will

provide benefit to around 50 lakh employees of the Central Government, who also

include defence and railways. Apart from this, it will also provide benefit to

30 lakh pensioners.

• The Union Government of India constitutes

the Pay Commission after almost 10 years time frame in order to revise the pay

scales of employees. The recommendations of Pay Commission are always adopted

by all the states in India after a few modifications.

Finance Ministry Order Issued: Dearness Allowance(DA) to Central Government Employees- Revised Rate effective from 01.07.2013

Finance

Ministry Order Issued: Dearness Allowance(DA) to Central

Government Employees- Revised Rate effective from

01.07.2013

Saturday, September 21, 2013

Govt launches austerity measures; no creation of new jobs or filling of posts lying vacant for over one year.

Govt launches austerity measures; no

creation of new jobs or filling of posts lying vacant for over one year.

Central government on 18 September 2013

(Wednesday) unveiled austerity measures, putting a freeze on fresh

appointments, banning holding of its conferences in 5-star hotels and barring

officials from executive class air travel, in a bid to check fiscal deficit

from going out of control.

Battling slow economic growth and not too

robust tax collections yet, the government came out with a slew of measures

that will ensure that Ministries and departments will not buy new vehicles,

create new jobs or fill posts lying vacant for over one year.

The Finance Ministry on Wednesday issued a

circular containing the steps, which will cut non-Plan expenditure by 10 per

cent, a day after Finance Minister P. Chidambaram met Financial Advisors of

various Ministries to impress upon them the need for austerity and to contain

expenditure within the budget target.

The measures aim at restricting the fiscal

deficit to the budgeted figure of 4.8 per cent of the GDP in 2013-14.

The Ministry has directed that the size of

delegations going abroad should be kept at “absolute minimum.”

“Such measures are intended at promoting

fiscal discipline, without restricting the operational efficiency of the

government. In the context of the current fiscal situation, there is a need to

continue to rationalise expenditure and optimise available resources,” the

Ministry said. Mr. Chidambaram had earlier said that he had drawn a red line

and would not allow the fiscal deficit to breach the target of 4.8 per cent of

the GDP in 2013—14. The various austerity measures helped the government to

contain the fiscal deficit at 4.9 per cent of the GDP in the previous financial

year, against the budgeted target of 5.1 per cent.

Referring to jobs in government

departments, it said there will be a total ban on new posts and those that have

remained vacant for more than a year will not be filled except under very rare

and unavoidable circumstances.

10% DA hike for Central government employees w.e.f 01 July 2013

10% DA hike for

Central government employees w.e.f 01 July 2013

Union Cabinet on 20 September 2013 (Friday)

approved a double-digit increase of 10% in dearness allowance from existing 80%

to 90 per cent, benefiting 50 lakh Central government employees and 30 lakh

pensioners, with effect from July 1, 2013.

Significantly, the double-digit increase in

DA has come after a gap of about three years. Since the government uses CPI-IW

(Consumer Price Inflation – Industrial Workers) data for the previous 12 months

to arrive at a figure for computation of any increase in DA instalment, the

percentage hike is based on the retail inflation data for July 2012-June 2013.

The previous DA hike of 10 per cent was in September 2010 when the government

announced an additional instalment given with effect from July 1 that year.

In April this year, the government

announced DA increase from 72 to 80 per cent with effect from January 1, 2013.

Official Release on PIB read as follows:

Release of

additional installment of dearness allowance to Central Government employees

and dearness relief to Pensioners, due from 1.7.2013

The Union Cabinet today approved the

proposal to release an additional installment of Dearness Allowance (DA) to

Central Government employees and Dearness Relief (DR) to pensioners with effect

from 01.07.2013, in cash, at the rate of 10 per cent increase over the existing

rate of 80 per cent.

Hence, the Central Government employees as

well as the pensioners are entitled for DA/DR at the rate of 90 per cent of the

basic with effect from 01.07.2013. The increase is in accordance with the

accepted formula based on the recommendations of the 6th Central Pay

Commission.

The combined impact on the exchequer on

account of both dearness allowance and dearness relief would be of the order of

Rs. 10879.60 crore per annum and Rs. 7253.10 crore in the financial year

2013-14 ( i.e. for a period of 8 month from July, 2013 to February 2014).

Official order from

finmin is expected soon and the same will be posted in this blog immediately on

release by finmin. Keep Visiting!!!